Why The Bitcoin Halving Matters: Unveiling the pivotal event reshaping the landscape of digital currency and global finance.

When you figure out what happened with Bitcoin’s split, you’ll see a mysterious and important financial event. Come into the world of cryptocurrencies with us as we solve the mystery of Bitcoin Halving, from its roots in history to its huge effects on markets around the world.

Come with us as we explore its complex technological aspects, its effects on the economy, and the way it has spread across businesses around the world.

Get ready to go on a journey into the heart of Bitcoin’s history and learn about the methods investors use today.

Get ready to learn more than ever before about what the Bitcoin Halving means.

Table of Contents

ToggleWhat is Bitcoin Halving?

Bitcoin is different from standard financial systems because it is based on a decentralized network.

Bitcoin is a digital currency that was created in 2009 by someone going by the name Satoshi Nakamoto. It lets people send money to each other without banks or states getting in the way.

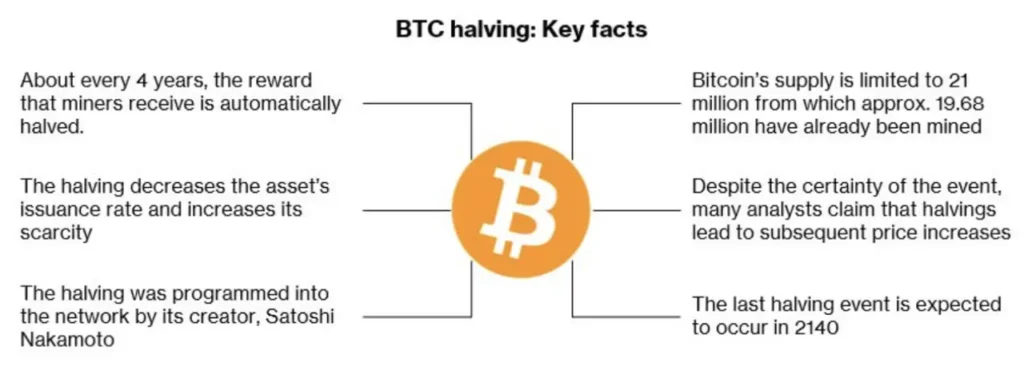

One of the most important parts of the Bitcoin ecosystem is a function called “Bitcoin Halving.” This important event happens about every four years and is built into the Bitcoin system.

Bitcoin halving means that the prize that Bitcoin miners get for checking transactions and keeping the network safe is going down.

At first, the prize was 50 BTC per block. However, halving events cut it in half, first to 25, then to 12.5, and so on. This carefully thought-out system controls the flow of new Bitcoins, with 21 million being the maximum number that can ever be mined.

So, Bitcoin Halving is an important part of how Bitcoin works because it affects its value, how scarce it is, and how mining works.

Why The Bitcoin Halving Matters

It is important to understand why the Bitcoin halving is happening to fully understand its huge effects on the cryptocurrency community and beyond.

Unlike traditional fiat currencies that the central bank can change, Bitcoin has a set supply plan that is controlled by code. It’s important because it can keep things scarce and protect against inflationary forces. The rate at which new Bitcoins are put into circulation is cut in half with each halving event.

This slows the rate of supply growth over time. This form of scarcity is similar to precious metals like gold. It gives Bitcoin value and builds trust among its users.

In addition, the halving process protects the economy and makes sure that the Bitcoin network will last for a long time.

In this way, the Bitcoin Halving is a key event that affects how investors feel, how the market works, and how cryptocurrencies are used in the global economy as a whole.

History of Bitcoin Halvings

Bitcoin’s past of halving shows how strong the cryptocurrency is and how far it has come on its way to becoming a global currency.

The first Bitcoin halving happened in 2012, and it was a very important time in the history of the new currency. The block prize dropped from 50 BTC to 25 BTC because of this event. This set a standard for future halvings.

The second halving happened in 2016, which cut the block prize even more, to 12.5 BTC. At the same time that this milestone was reached, popular interest and investment in Bitcoin grew quickly, sending its price to all-time highs.

The most recent Bitcoin halving happened in 2020, and investors and fans alike were very excited and paying close attention. The fact that the block prize was cut in half again to 6.25 BTC made this event even more important because it showed that Bitcoin is deflationary and a good way to save money.

Each halving event is a major turning point in Bitcoin’s history. It changes the way markets work and affects the overall path of the cryptocurrency environment.

Understanding the Mechanism

To fully understand the importance and effects of Bitcoin Halving on the cryptocurrency ecosystem, you need to know how it works.

The process of Bitcoin halving is closely linked to the idea of mining, which is what makes the Bitcoin network work.

By solving hard math problems, miners are very important for making sure that transactions are correct and keeping the network safe. Miners are paid with brand-new Bitcoins for their work. This is called the block reward.

However, to keep Bitcoin’s limited quantity and stable price, the protocol changes the block reward on its own every four years. This is called the Bitcoin Halving. The payment miners get for each successful block they mine is cut in half during a halving event.

This slows down the rate at which new Bitcoins are released into circulation. Reduced mining benefits are very bad for miners because they affect their ability to make money and encourage the mining industry to be more efficient and come up with new ideas.

As a result, Bitcoin Halving is a very important part of creating the Bitcoin network, which in turn affects its security, scarcity, and economic value.

Economic Implications

The halving of Bitcoin has economic effects that can be felt all over the bitcoin market. These effects are caused by the way that supply and demand work together.

Every time there is a half event, the number of new Bitcoins entering circulation slows down.

This means that fewer Bitcoins are available. This model of scarcity, similar to precious metals like gold, gives Bitcoin value and boosts investor trust.

Because of this, Bitcoin halving events often cause a supply shock, which raises demand and pushes prices up. How the market responded to earlier halvings can teach us a lot about this trend.

After the first split in 2012, Bitcoin’s price went through a big bull run, reaching all-time highs over the next few months and years. In the same way, the second half in 2016 happened at the same time that investor interest grew and Bitcoin’s value rose significantly.

These examples from the past show how much Bitcoin Halving will affect the economy, changing the way markets work and how investors act in the bitcoin space.

Technological Perspectives

From a technical point of view, Bitcoin Halving brings up a few important issues that affect how the network works.

One of these is the part of mining difficulty. The Bitcoin protocol changes the level of difficulty to keep the rate of block production steady, even if the number of miners trying to solve cryptographic puzzles goes up or down.

When halving happens, block payouts can go down, which can make it less profitable for miners and could even cause some to leave the network. In response, the level of challenge for mining may change to keep the rate of block production steady.

The Bitcoin network needs to keep this delicate balance between mining challenge and block rewards in order to stay safe and stable. When we talk about security, Bitcoin Halving also has a big effect on network security.

As the block rewards go down, miners have to depend more and more on transaction fees to keep their businesses going. This gives miners a reason to give more weight to transactions with higher fees, which could make it take longer for transactions with smaller fees to be confirmed.

There have been changes in the Bitcoin network, but the security is still strong because of the computing power of its autonomous network of miners. In the end, Bitcoin Halving makes the network stronger and safer, even though it may cause some technical problems in the short term.

Price Volatility and Speculation

Price changes and rumors about Bitcoin halving events have become important parts of the altcoin market. When there is a halving coming up, people often speculate, which drives up demand and costs.

Historical patterns show that the time before a halving is usually a time of optimism, as buyers try to make money off of the expected drop in supply.

This big rise in demand can cause the price to go up a lot.

For example, Bitcoin hit all-time highs in the months before earlier halvings. But price changes after a half can be more complicated.

There may be a range of immediate responses to halving events, with price spikes followed by consolidation or corrections.

However, Bitcoin’s long-term trend tends to represent its underlying scarcity and adoption trends. Even though prices may go up and down in the short term, the bigger story of decreasing supply and rising institutional interest often keeps prices going up after half events.

So, Bitcoin’s price volatility may be hard for some buyers, but it can also be good for those who are willing to look at the market with a long-term view.

Influence on Mining Industry

The halving of Bitcoin has had a huge effect on the mining business, changing the way miners around the world make money.

One effect that is felt right away is on workers’ income. Each time there is a halving event, the block reward miners get for validating transactions is cut in half. This means that they make less money altogether.

Miners may have a hard time with this drop in income, especially if they are using expensive or less efficient hardware.

As a result, some miners may have to rethink their strategies or leave the market altogether, which could cause changes in how mining power is distributed across the network.

But because of shifting economic motivations, the mining industry often changes and adapts very quickly. Mining hardware changes are becoming more common as miners try to keep making money even though the rewards are going down.

As part of these changes, companies usually buy more powerful and efficient mining equipment to compete in an increasingly competitive market.

By using new technology, miners can lessen the effects of splitting events and ensure they can continue to help protect the Bitcoin network.

Adoption and Institutional Interest

Following a Bitcoin halving event, investors’ attitudes change dramatically. The halving process makes Bitcoin even more scarce, which makes investors feel the need to act quickly and raises its value.

This rise in what people think the price is worth often leads to more investors and more action in the market.

In addition, the reduction makes big businesses more interested in Bitcoin.

Institutions tend to put more money into Bitcoin after each split event because the asset’s deflationary nature and long-term value growth appeal to them.

This increased involvement from institutions not only proves that Bitcoin is a real asset class, but it also makes the market more liquid and stable.

This means that after a halving, there is often a surge in institutional investment, which makes Bitcoin an even better way to keep value and make investments.

Environmental Concerns

The event of halving Bitcoin brings to the forefront the ongoing argument about how much energy Bitcoin mining uses.

Critics say that creating Bitcoin uses a lot of energy and makes environmental problems worse because it relies on fossil fuels.

This argument usually gets stronger after the halving because the smaller block payouts can make miners compete more, which increases the amount of energy used.

Despite these worries, however, the mining business has been putting more and more focus on efforts to be more environmentally friendly.

Many mines are constantly looking for ways to reduce their carbon footprint by switching to clean energy sources like hydroelectricity, solar power, and wind power.

New hardware and methods for mining are also being developed to use less energy and have less of an effect on the earth.

As the industry grows, these attempts to be more environmentally friendly are very important for reducing the damage that Bitcoin mining does to the environment and easing concerns about how much energy it uses.

Regulatory Challenges

When Bitcoin is cut in half, governments and financial officials often take stronger regulatory actions. This is because these events show how cryptocurrencies are changing.

The halving of Bitcoin could be seen as a key moment for governments to rethink and possibly change the rules they have about cryptocurrencies.

Concerns about protecting investors, keeping the economy stable, and illegal activities may lead governing bodies to make the cryptocurrency market more closely watched by putting in place stricter rules or new policies.

The cryptocurrency market may also be affected by a number of legal issues, such as taxes, rules and regulations, licensing, and police actions.

So, figuring out how to deal with regulations after the halving needs careful thought and flexibility to make sure that new rules are followed while also encouraging growth and innovation in the cryptocurrency environment.

Future Projections

People often guess about future Bitcoin halvings by making predictions about the cryptocurrency’s price and how the market will work.

Some experts think that as the number of newly created bitcoins decreases with each halving event, the lack of supply will increase demand, which could cause the price to rise significantly over time.

But these predictions could change depending on things like how the market feels, new technologies, changes in regulations, and overall economic trends.

Even though there are a lot of unknowns, the long-term effects of Bitcoin are still a very interesting and controversial subject.

Many supporters say that Bitcoin’s limited quantity and decentralized nature make it a good way to protect against inflation and the loss of value of fiat currencies.

This means that Bitcoin could be used as a store of value and a way to pay in the future.

Also, the fact that Bitcoin is becoming more and more accepted by businesses and regular people makes people even more hopeful about its long-term growth and viability.

Still, Bitcoin’s future and its wider effects will keep changing as the cryptocurrency community grows and changes to meet new challenges and take advantage of new opportunities.

Investor Strategies Post-Halving

One common method is “hodling,” which means buyers keep their Bitcoin for a long time in the hopes that its value will rise over time. The idea behind this approach is that Bitcoin’s limited supply will make people want it more, which will eventually cause prices to rise.

However, some buyers like trading strategies, taking advantage of short-term price changes to make money by buying and selling Bitcoin. No matter what approach is used, managing risks well is essential for minimizing possible losses and maximizing returns.

Diversification, setting stop-loss orders, and rebalancing your portfolio are all strategies that can help investors control the amount of risk they are exposed to and keep their investments safe during market instability.

Also, investors who want to do well in the market after the halving must stay up to date on market trends, do a lot of study, and stick to a disciplined investment strategy.

Conclusion

In sum, Bitcoin halving is important for a lot more reasons than just lowering block rewards. It shows what Bitcoin’s economic model is all about by showing how deflationary it is and how complexly supply and demand work together.

By figuring out what happened when Bitcoin was cut in half, we find a story with many layers: economic, technical, environmental, regulatory, and socioeconomic.

When we think about the past, mechanics, and effects of Bitcoin halving, we can learn a lot about how the cryptocurrency ecosystem has changed over time and how it might change in the future.

The road ahead may be uncertain and difficult, but Bitcoin and its community’s strength and ability to change show a strong trust in the power of decentralized digital currencies to change the world.

Let’s face the uncharted seas of the time after the halving with a mix of cautious optimism, smart decision-making, and a dedication to promoting innovation, sustainability, and inclusion in the rapidly growing field of cryptocurrency.

Frequently Asked Questions

What is Bitcoin halving?

Bitcoin halving is an event that occurs approximately every four years, during which the rewards for mining new blocks on the Bitcoin blockchain are halved. This reduction in block rewards is programmed into Bitcoin's protocol and serves to control the issuance rate of new bitcoins, ultimately aiming to limit the total supply of Bitcoin to 21 million coins.

How does Bitcoin halving affect the price?

Bitcoin halving typically affects the price by increasing scarcity and reducing the rate at which new bitcoins are introduced into circulation. This scarcity tends to drive up demand for Bitcoin, leading to upward pressure on its price. Historically, Bitcoin halving events have been associated with periods of significant price appreciation, as investors anticipate the reduced supply of new bitcoins.

What are the implications of Bitcoin halving on mining?

The implications of Bitcoin halving on mining are twofold. Firstly, it reduces the rewards earned by miners for validating transactions and securing the Bitcoin network. As a result, miners may experience a decrease in their profitability, especially if they have high operational costs. Secondly, Bitcoin halving often leads to increased competition among miners, as they strive to maintain their profitability despite the reduced rewards. This competition can incentivize miners to improve their efficiency and seek lower-cost energy sources.

Is Bitcoin halving sustainable in the long term?

Whether Bitcoin halving is sustainable in the long term depends on various factors, including technological advancements, regulatory developments, and market dynamics. While Bitcoin halving serves to control inflation and maintain scarcity, its long-term sustainability relies on continued adoption, innovation, and resilience within the Bitcoin ecosystem. Additionally, addressing concerns related to energy consumption, environmental impact, and regulatory uncertainty will be crucial for ensuring the sustainable growth and viability of Bitcoin over time.