Any guess how money works in the digital world? Imagine making transactions without using traditional banks or physical cash. That’s the magic of digital currency, like cryptocurrency. In this guide, we’ll break down the basics and tell you what is digital currency and why it’s a big deal.

Digital currency is like electronic money, but no government controls it.

It runs on something called blockchain, making transactions super safe and transparent. We’ll explore how it all started and what makes digital currency so special.

Now, why should you care? Well, digital currency is changing how we handle money globally. It’s efficient, secure, and available to everyone.

Join us to learn about the key players, the latest trends, and what the future might hold.

Ready to dive into the world of digital currency?

Let’s go on this adventure together and discover what the future of money looks like!

Table of Contents

ToggleWhat Is Digital Currency?

Digital currency is a type of electronic money that doesn’t exist in physical form. Unlike traditional currencies, it operates online, and its transactions are secured by a technology called blockchain.

This decentralized system ensures that transactions are transparent, secure, and not controlled by any government.

In simpler terms, digital currency is like the money you use every day, but it only exists in the digital space. It’s not stored in banks or carried in your pocket.

Instead, it’s based on technology that keeps track of who owns it and how it’s used.

As we explore this concept further, we’ll delve into its origins, how it works, and why it’s becoming increasingly important in the ever-evolving world of finance.

Get ready to demystify the world of digital currency!

Types of Digital Currencies

In the vast landscape of digital currencies, there are several types that play distinct roles.

1. Cryptocurrencies, such as Bitcoin, Ethereum, and various Altcoins, form a significant category.

The frontiersperson Bitcoin operates on a decentralized network and is often referred to as digital gold.

On the other hand, Ethereum goes beyond a mere currency and enables smart contracts and decentralized applications.

Altcoins encompass a variety of digital currencies other than Bitcoin, each with its unique features and purposes contributing to the diverse crypto ecosystem.

2. Central Bank Digital Currencies (CBDCs) represent another crucial category. A CBDC is a digital form of a country’s official currency issued and regulated by the central bank.

Unlike cryptocurrencies, CBDCs are centralized and backed by the government.

This evolution in the financial landscape raises questions about the role of central banks in the digital era and how CBDCs might shape the future of money.

3. Stablecoins form yet another fascinating category of digital currencies. These are designed to minimize the volatility often associated with cryptocurrencies like Bitcoin.

Tethered to the value of traditional fiat currencies or commodities, stablecoins offer a more stable and reliable digital exchange.

Exploring the intricacies of stablecoins involves understanding how they maintain a fixed value, providing a bridge between the digital and traditional financial worlds.

As we navigate the realm of digital currencies, these categories showcase the diverse and dynamic nature of the evolving financial landscape.

How Digital Currencies Work

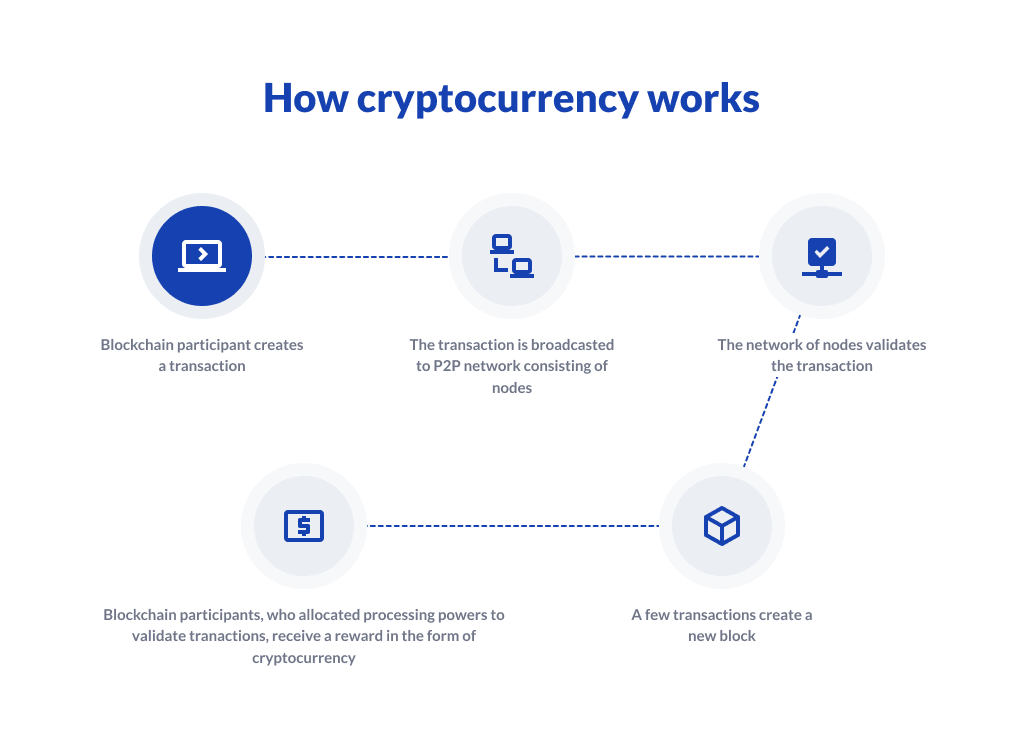

In grasping the essence of digital currency, it’s crucial to crack the mechanics of how these currencies operate in the digital realm.

At the heart of this financial revolution is blockchain technology. This decentralized ledger acts as a digital record-keeper, ensuring transparency, security, and immutability in every transaction.

When someone initiates a digital currency transaction, it is bundled into a block, which is then cryptographically linked to the previous block, forming an unalterable chain of transactions.

Decentralization is a key principle that sets digital currencies apart from traditional financial systems. Unlike centralized authorities such as banks or governments, digital currencies operate on a network of computers, each serving as a node in the blockchain.

This peer-to-peer network eliminates the need for intermediaries, fostering trust and reducing the risk of fraud. Decentralization ensures that no single entity has control over the entire system, democratizing the financial landscape.

Smart Contracts represent another revolutionary aspect of digital currencies, particularly exemplified by platforms like Ethereum. Smart contracts are self-executing agreements with the terms of the contract directly written into code.

These contracts automatically execute and enforce themselves when predefined conditions are met, eliminating the need for intermediaries.

For example, in a real estate transaction, a smart contract could automatically transfer ownership once payment is received, streamlining processes and reducing costs.

Understanding how digital currencies work involves appreciating the synergy between blockchain technology, decentralization, and the automation capabilities of smart contracts.

This powerful combination not only ensures the security and transparency of transactions but also opens up new possibilities for efficient, trustless, and decentralized financial interactions.

When someone initiates a digital currency transaction, it’s recorded on a block within the blockchain. These blocks are linked together in a chain, creating a tamper-resistant and verifiable record of every transaction.

Cryptocurrencies, like Bitcoin and Ethereum, utilize a mining consensus mechanism to validate transactions and add them to the blockchain.

Miners, equipped with powerful computers, solve complex mathematical problems, securing the network and ensuring the integrity of the digital currency system.

This process not only validates transactions but also introduces new units of the cryptocurrency into circulation.

Central Bank Digital Currencies (CBDCs), in contrast, operate in a more centralized fashion. Issued and regulated by central banks, CBDCs involve the digital representation of a country’s official currency.

Transactions are recorded in a central database maintained by the central bank, allowing for oversight and control. This approach contrasts with the decentralized and open nature of most cryptocurrencies.

Understanding how digital currencies work also involves exploring the concept of wallets.

Digital wallets serve as the user’s interface to the digital currency world, providing a secure space to store and manage their digital assets.

These wallets come in various forms, including hardware wallets, software wallets, and even paper wallets, each offering different levels of security and accessibility.

Advantages of Digital Currencies

Digital currencies have some really cool benefits that are changing the way we do money stuff.

First off, they’re like superheroes for including everyone in the money world. In many places, regular banks are too far away, and lots of people can’t use them. But digital currencies are like a friendlier bank on your phone, making sure everyone can be part of the money fun and do business worldwide.

Next up, they’re like superguards for your money. Imagine a secret code that keeps all your money moves safe. That’s what digital currencies do with their fancy blockchain tech. It makes sure no one can mess with your money or steal your identity. It’s like having a superhero shield for your cash.

And guess what? Digital currencies are like speedsters for transactions. Regular banks can be a bit slow with lots of middlemen, making things complicated and pricey.

But digital currencies make things super quick and cheap. No middlemen means fewer mistakes, and it’s like magic for sending money across the world instantly and securely.

So, digital currencies are like the cool kids in the money club, making things fair, safe, and super fast for everyone.

Challenges and Concerns

Regulatory Challenges:

Understanding digital currency involves navigating through regulatory challenges. Governments and financial institutions are working to create rules for these currencies, but there’s no global standard yet.

This lack of consistency creates uncertainty for businesses and users, making it crucial to establish a comprehensive framework that everyone can follow.

Volatility:

One of the big concerns in the digital currency world is its unpredictable nature. Popular cryptocurrencies like Bitcoin and Ethereum can go through significant value changes, offering both opportunities and risks for investors.

This volatility raises doubts about how reliable and steady digital assets are as a form of value storage.

Cybersecurity Risks:

Digital currencies are appealing to cybercriminals due to their decentralized structure. This makes them vulnerable to hacks and scams, putting users’ assets and personal information at risk.

The prevalence of data breaches underscores the importance of implementing strong security measures to protect users and ensure the safe use of digital currency in the financial world.

Adoption and Impact

Global Adoption Trends:

Digital currencies, like Bitcoin and Ethereum, are getting popular worldwide. People and businesses from different places are using these new kinds of money more and more.

The cool thing is, these digital currencies work without needing a specific country or bank. It’s like money that everyone, no matter where they are, can use easily.

Influence on Traditional Banking:

Traditional banks are feeling the change because of digital currency. Cryptocurrencies work without needing banks in the middle. Some banks are trying to use the technology behind digital currency, called blockchain, to make their own systems better.

Also, there’s a new idea called decentralized finance (DeFi) where people can do things like borrowing and lending money directly on special online platforms, without needing a traditional bank.

Impact on Governments and Economies:

Governments and big banks are figuring out how to deal with digital currency. They worry that it might be used for things like illegal activities and tax issues because it’s not as easy to track.

Some countries are thinking about making digital money to have better control. The way we use money might change a lot, and governments need to find the right balance between making sure things are fair and letting new ideas happen.

Digital Currency Wallets

In the digital money world, keeping your coins safe is super important, and that’s where digital currency wallets come in handy.

There are two main types: hardware wallets and software wallets.

Hardware wallets are like super-secure vaults for your digital money. They’re physical gadgets that keep your private keys offline, making hacking harder for bad guys. Popular ones are Ledger and Trezor – known for being tough to crack.

Software wallets, on the other hand, are digital wallets you can use on your computer, phone, or online. There are hot wallets (connected to the internet) and cold wallets (offline).

Examples are Trust Wallet for your phone and Coinbase for online use. While they’re convenient, they can be more at risk of cyber threats, so you’ve got to be careful.

Keeping it secure is a big deal no matter which wallet you pick. Use strong passwords, turn on two-factor authentication, and don’t share your private keys.

Stay updated on the latest security info in the digital money world too. Being smart about wallet security is critical to keeping your digital money safe and sound!

Buying, Selling, and Trading Digital Currencies

In the dynamic realm of digital currency, engaging in buying, selling, and trading activities is integral to navigating the market successfully.

Cryptocurrency Exchanges: These online platforms are the primary lines for users to buy and sell digital currencies. Popular exchanges like Coinbase, Binance, and Kraken offer a diverse range of cryptocurrencies, providing users with many options.

Security and regulatory compliance should be paramount considerations when selecting an exchange, as these factors greatly influence the safety and legality of transactions.

Trading Strategies: Developing effective trading strategies is crucial for optimizing returns in the volatile digital currency market. Traders often employ various techniques such as day trading, swing trading, or long-term investing based on their risk tolerance and market analysis.

Fundamental and technical analyses are commonly used tools, helping traders make informed decisions by assessing factors like market trends, project developments, and historical price data.

Risks and Mitigation: Despite the potential for lucrative gains, the digital currency market has risks. Volatility, market manipulation, and security vulnerabilities are inherent challenges.

To mitigate risks, diversifying the investment portfolio, setting stop-loss orders, and staying informed about market trends can be effective strategies.

Additionally, adopting secure practices such as using hardware wallets and enabling two-factor authentication enhances safety when engaging in digital currency transactions.

A comprehensive understanding of these elements empowers individuals to confidently navigate the intricate landscape of buying, selling, and trading digital currencies.

Future Trends in Digital Currencies

Looking ahead at what’s coming for digital currencies, we see three essential things:

- More and more countries are considering using digital versions of their money, called central bank digital currencies. This could make it easier for everyone to access money and make payments.

- Digital currencies are starting to mix with regular money and finance systems. This could change how we invest and manage our money.

- Technology is getting better, making digital currencies safer and more efficient.

Things like smart contracts and improved systems are making digital money more reliable.

So, in the future, digital currencies might be a big part of how we handle our money, thanks to these changes in central banks, mixing with regular money, and getting better with technology.

Legal and Regulatory Landscape

In the world of digital money, understanding the rules and regulations is super essential for everyone involved.

Global Regulatory Approaches: Different countries have different ways of dealing with digital money. Some places, like Japan and Switzerland, have clear rules to make digital money part of their official financial systems.

Others, like China, have strict rules or even say no to digital money. Because of this, it’s crucial to know and follow the rules in each region.

Compliance Requirements: Using and handling digital money comes with some rules you need to follow. Things like making sure people using digital money are who they say they are (Know Your Customer) and preventing money laundering are big concerns.

Businesses in the digital money world often have to register, follow safety rules, and report certain things. Following these rules helps build trust and shows that digital money is being used safely and legally.

Emerging Regulatory Trends: The rules for digital money are still changing, and there are some new trends to watch. Governments and groups are figuring out how to ensure digital cash is used safely without stopping innovation.

They’re talking about government-backed digital money, how to tax digital money, and creating safe spaces for new ideas to be tested.

Keeping up with these trends is essential to understanding where digital money is headed and how it can grow responsibly.

Digital Currency and the Economy

Digital currency has changed how our economy works, affecting the rules set by banks and introducing new ways of handling money.

Monetary Policy Implications: Because digital currency is decentralized and can be used globally, it is tricky for central banks to control things like how much money is available and the interest rates.

This means they have to find new ways to manage the economy.

Inflation and Deflation: Digital currency can make prices go up or down. The easy and quick way people can buy things with digital money might cause prices to rise.

However, some digital currencies have a limit on how much can exist, which could stop prices from going too high.

Economic Stability: Adding digital currencies into our money system can make things more stable or cause problems. The quick and transparent way digital transactions happen can help keep our finances in order.

But, because some digital currencies can change in value a lot, it might make our money system less reliable.

Finding the right balance between new ideas and ensuring things stay safe is crucial as we use more digital currencies in our economy.

Social and Environmental Impact

In the world of digital money, it affects both people and the environment in different ways.

Let’s break it down:

Digital money helps include more people in the financial system. Imagine folks who don’t have a bank account getting access to money services through their phones.

That’s what we mean by financial inclusion, and it’s a big deal for giving everyone a fair chance.

But, there’s a catch. Making digital money uses a lot of energy, and that’s not great for the planet. We need to figure out how to use this technology without hurting the environment too much.

On the bright side, digital money can also make things fairer. It lets people send money directly to each other, skipping the middleman.

This could help folks who usually don’t have access to banks. Yet, we need to be careful that digital money doesn’t make existing problems worse.

As we keep exploring digital money, we need to think about how it affects people and the world around us, making sure it’s a win for everyone.

Future Challenges and Opportunities

Looking into the future of digital currency, challenges, and exciting possibilities are ahead.

Scalability Issues: Consider it like handling a growing crowd—making sure transactions happen quickly as more people join the digital currency world. Solutions like sharding and layer-two scaling are being explored to keep things running smoothly.

Innovation Opportunities: Despite challenges, there’s a lot of room for creative ideas. Smart contracts and decentralized finance are changing how we handle money, making things more inclusive and accessible.

Interoperability Challenges: Making different digital currencies seamlessly work together is tricky right now. We need standardized rules to make them all play well together.

Efforts are underway to create solutions for smooth interactions between different digital currencies. Figuring out these challenges and embracing innovative ideas will be vital in shaping the future of digital currencies.

Educating the Masses

Helping everyone understand digital currency is crucial, and there are three main ways we’re doing it:

- There are Digital Currency Literacy Programs. These are like classes that teach you the basics of digital money, from how it works to how you can use it.

- There are Public Awareness Initiatives. These are efforts to spread the word about digital currencies through social media and TV, ensuring everyone knows both the good and not-so-good sides.

- There are Educational Resources, like easy-to-read guides and videos you can find online.

These resources let you learn about digital currency at your own pace, making it more straightforward for everyone to be in the know.

Together, these efforts are ensuring more people understand digital currency, making our future more knowledgeable and inclusive.

Conclusion

To sum it up, digital currencies are changing how we use money. We’ve explored the different types, how they work, the good things they bring, and the challenges.

They’re becoming a big part of our economies and affecting how we buy, sell, and trade. Looking forward, we must teach everyone about digital currencies to smooth this shift.

It’s a big change with both challenges and chances, and it’s up to all of us to make sure it’s a positive and fair change for everyone.

I hope you enjoyed my article! It’s my first one about cryptocurrencies, and I’m excited to share more since I’m into investments. I made a separate website just for this topic.

Let me know what you think, and feel free to add anything.

Also, subscribe to our email updates to stay in the loop. Thanks a lot for spending your time reading the whole article!

Frequently Asked Questions

How is Digital Currency Different from Traditional Currency?

Digital currency differs from traditional currency in that it exists exclusively in electronic form, without a physical counterpart like coins or banknotes. Unlike traditional currency, which is centralized and often issued by governments, digital currency operates on decentralized technology, such as blockchain, and is not controlled by any single authority. Transactions with digital currency are typically conducted online and offer the potential for increased security, transparency, and efficiency compared to traditional currency systems.

Is Digital Currency Legal Everywhere?

No, the legal status of digital currency varies worldwide. While some countries embrace and regulate digital currency, others restrict or outright ban its use. Legal acceptance depends on individual jurisdictions and their evolving regulatory frameworks.

What are the disadvantages of digital money?

The disadvantages of digital money include potential cybersecurity risks, technological barriers for some individuals, the risk of digital fraud, and the lack of physical presence, which may lead to loss of funds in case of technical failures or hacking incidents. Additionally, concerns about privacy and the potential for centralizing financial power are drawbacks of digital money.

What are the advantages of digital money?

The advantages of digital money include increased convenience for transactions, accessibility, reduced reliance on physical currency, faster payment processing, lower transaction costs, and the potential for financial inclusion, especially in areas with limited banking infrastructure. Digital money also allows for easier tracking and management of transactions, promoting transparency and efficiency in financial systems.

What is the difference between electronic money and digital money?

The terms "electronic money" and "digital money" are often used interchangeably, but there's a subtle difference. Electronic money refers specifically to digitally stored monetary value on electronic devices, like prepaid cards or mobile wallets. On the other hand, digital money is a broader term encompassing all forms of money in digital form, including cryptocurrencies and electronic money. In essence, electronic money is a subset of digital money.

What are the pros and cons of digital currency?

Pros of digital currency include increased convenience, faster transactions, lower costs, financial inclusion, and transparency. However, cons include cybersecurity risks, potential for fraud, technological barriers for some, lack of privacy, and volatility in the case of specific cryptocurrencies.

How to create digital currency?

Creating a digital currency typically involves blockchain technology, consensus mechanisms, and cryptographic protocols. It requires expertise in programming and blockchain development. Steps may include:

- Defining the purpose and features.

- Selecting a consensus algorithm.

- Designing the blockchain architecture.

- Coding the intelligent contracts (if applicable).

- Implementing security measures.

It's essential to comply with legal and regulatory requirements during development. Engaging with a knowledgeable development team or using existing blockchain platforms can streamline creation.