The renowned crypto analyst Cold Blooded Shiller (@ColdBloodShill) offers his 280,000 followers on X a comprehensive analysis of the troubled Bitcoin market.

In his commentary, titled “Ultimate BTC Simple Bias Guide,” he discusses the recent emotional reactions to Bitcoin’s price fluctuations and provides a strategic approach to understanding these changes.

Table of Contents

ToggleShould You Buy Or Sell Bitcoin Now?

The price of Bitcoin dropped sharply on Friday, from $71,900 to $68,500.

This happened at the same time as the release of the US Employment Situation Summary Report, a key economic indicator that often has an impact on market sentiment across many asset classes, including cryptocurrency.

“It’s easy to forget that a single red candle on Friday caused a big emotional response on Twitter,” Shiller writes, pointing out how people often respond to small events in the crypto market.

Not Warm Blooded Shiller’s technical study of Bitcoin shows that, despite the recent price changes, there is a strong uptrend going on.

He also finds important amounts of resistance and support that are needed to guess how Bitcoin’s price will move in the future.

This level of $72,000 has been a big resistance point for Bitcoin’s rise five times, with the most recent rejection happening last Friday.

Shiller says, “We have resistance at $72k,” which means that breaking above this level could start a big bullish trend.

Support levels at $67,000 and $61,000, on the other hand, are very important for keeping the bullish view alive. “BTC needs to keep its uptrend,” warns Shiller.

If we lose $67k, we’ll be back in a downturn, which means this is definitely a Lower High (LH) and the market is still bad.

He also says that a drop below $61,000 could mean the end of the current bullish cycle, which could lead to a weekly downturn as a whole.

Shiller points out that the Relative Strength Index (RSI), which is often used to predict market reversals, does not show any high time frame (HTF) negative divergences when looking at the bigger picture of the market.

It’s good to see that there are no HTF negative divergences, which are often strong signs of cycle tops. “The RSI is clear,” he says.

This finding suggests that the market may not yet be at a cycle peak, even though there are problems at key resistance levels.

This is good news for investors who are worried about possible downturns.

Shiller tells traders to keep a close eye on important price levels that will decide the short-term direction of the Bitcoin market.

He says, “The Daily needs to make a new high and break $72k; otherwise, it risks losing the Daily trend below $67k.”

These levels are very important for determining how people feel about the market and how they trade.

This tip stresses how important it is to be ready to make changes based on key technical signs, even if the overall trend stays positive.

Because of these lessons, Shiller tells his followers to plan how to handle their investment portfolios.

As of right now, the market is trying to break through resistance at $72,000 and support at important lower levels. This means that trading decisions need to be made tactically.

Traders and investors should set clear goals for when they will change their positions. This way, they can be ready for changes in the market that could affect their investments.

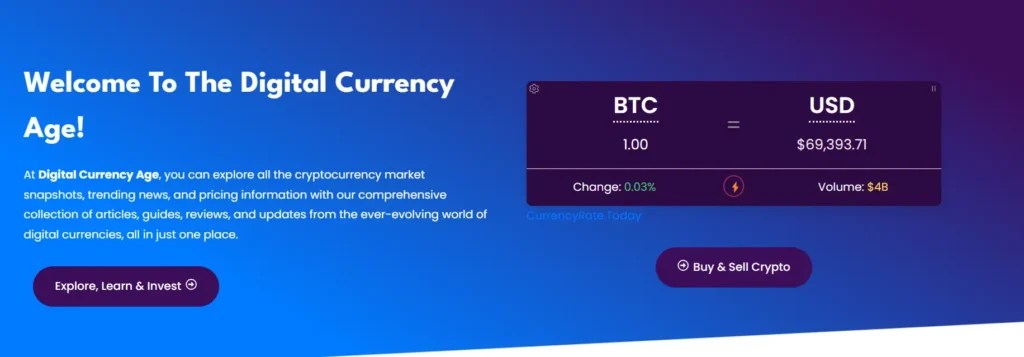

As of this writing, BTC was worth $69,393.