If you’re navigating the world of cryptocurrency and want to turn your Bitcoin into cash, understanding how to cash out Bitcoin on Coinbase is essential. As one of the most popular and reliable platforms for cryptocurrency transactions, Coinbase offers a seamless and secure way to convert your digital assets into fiat currency.

In the fast-paced world of cryptocurrencies, it’s important to know how to safely and quickly cash out your Bitcoin to get the most out of your investments and deal with market changes.

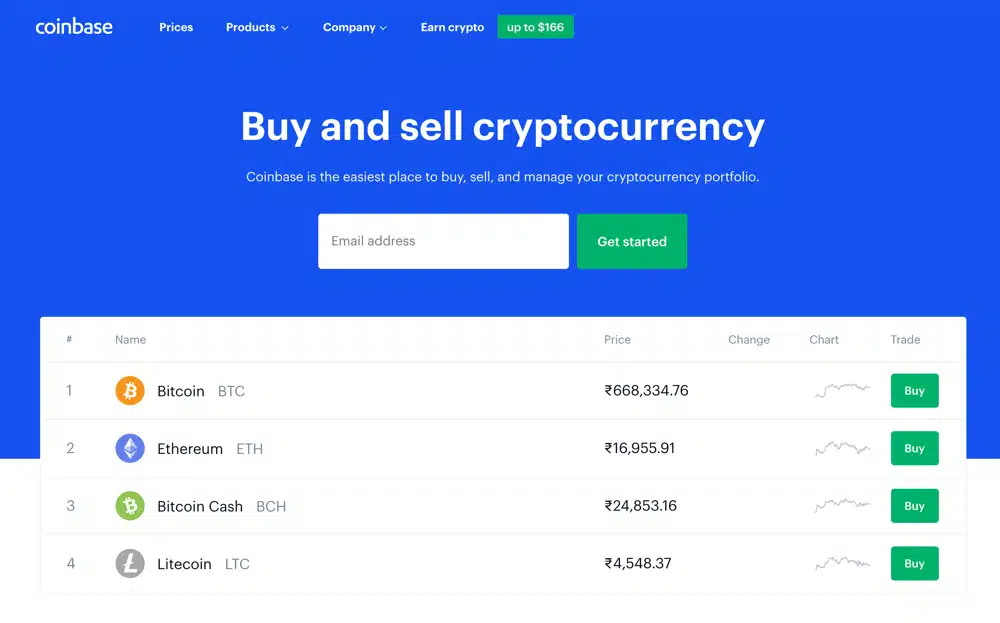

As a top cryptocurrency exchange site, Coinbase stands out for being reliable, having an easy-to-use interface, and having strong security features. This makes it a great choice for Bitcoin transactions.

Mastering the cash-out process can have a big effect on your financial plan, whether you want to turn your Bitcoin into regular money, try out other cryptocurrencies, or use Coinbase’s cool services like the Coinbase Card.

This guide will show you the basics of how to cash out your Bitcoin on Coinbase. It will also give you the best tips and tricks to keep your digital assets safe and help you make the most of them.

Table of Contents

ToggleUnderstanding Bitcoin Cashing Out

Cashing out Bitcoin refers to the process of converting your cryptocurrency into traditional fiat currency, such as USD, EUR, or GBP.

This typically involves selling your Bitcoin through a cryptocurrency exchange and transferring the resulting funds to your bank account or another payment method.

The primary reasons for cashing out Bitcoin include realizing profits from a successful investment, covering personal expenses, or rebalancing your investment portfolio.

As Bitcoin’s value can fluctuate significantly, converting it to fiat can help you lock in gains or manage risks.

Coinbase stands out as a preferred choice for many users due to its trustworthiness and reliability when it comes to cashing out Bitcoin.

Established as one of the leading cryptocurrency exchanges, Coinbase offers a secure platform with a strong reputation for safeguarding users’ assets.

Its intuitive interface and streamlined processes make it easy for both beginners and experienced traders to navigate the cash-out process efficiently.

Furthermore, Coinbase provides global accessibility, supporting a wide range of fiat currencies and payment methods, which ensures that users from different regions can effortlessly convert their Bitcoin into their local currency.

This combination of security, ease of use, and broad accessibility makes Coinbase a top choice for those looking to confidently cash out their Bitcoin.

Do You Want To Get Rich With Bitcoin Even If You Have No Clue About Technology?

This is your chance! You too can make hundreds of thousands even millions of dollars with Bitcoin if you don’t miss the boat.

Preparing to Cash Out on Coinbase

Before cashing out Bitcoin on Coinbase, setting up and securing your account properly is crucial.

Begin by setting up your Coinbase account, which requires creating an account with your email, followed by verifying your identity with government-issued ID.

Coinbase operates on different account levels, and higher verification increases your daily cash-out limits, allowing more flexibility for large transactions. Make sure you fully understand these limits to plan your withdrawals effectively.

Next, securing your Coinbase account is essential to prevent unauthorized access. Start by enabling two-factor authentication (2FA), adding an extra layer of security by requiring a unique code along with your password during login.

For added protection, create a strong password that includes a mix of letters, numbers, and special characters, and avoid reusing passwords from other platforms.

Additionally, set up security alerts within the Coinbase app or website to be notified of any unusual activity or login attempts.

Finally, linking a bank account or payment method is a crucial step to ensure smooth cash-outs.

On Coinbase, you can easily link your bank account by entering your banking details and confirming ownership through small test deposits. Alternative payment methods like PayPal or wire transfers are also supported, but each comes with its own transaction speed and fees.

Ensure that whichever payment method you choose is verified and ready before attempting a cash-out, as verification may take a few business days. With your account fully prepared, you can confidently move forward with cashing out Bitcoin on Coinbase.

How to Cash Out Bitcoin on Coinbase: Step-by-Step Guide

Method 1: Selling Bitcoin for Fiat Currency

To cash out Bitcoin on Coinbase, one of the most common methods is selling Bitcoin for fiat currency.

The process starts by placing a sell order. Navigate to the “Trade” tab on Coinbase and select Bitcoin from your assets. Click “Sell” and enter the amount of Bitcoin you wish to cash out.

You can choose to either sell your Bitcoin for a specific fiat currency, such as USD or EUR, which will then be transferred to your linked bank account or PayPal.

1. Sign in to your Coinbase account, on the web or mobile app

2. Select Buy & Sell

3. Select Sell

4. Select the crypto you want to sell, and the amount.

If on mobile, you’ll be required to crypto the asset you want to sell before entering an amount

5. Change the To destination, if applicable.

This will likely default to your local currency balance (USD) but you may have the option of adding to another balance (e.g., USDC).

6. Select Review order.

7. Select Sell now to complete the sale.

Once the crypto sell is complete, the funds will be available in your cash balance to buy other assets, or cash out to your bank.

When selling Bitcoin, it’s important to understand the difference between market orders and limit orders.

A market order allows you to sell your Bitcoin instantly at the current market price, which is the fastest way to cash out.

However, the price might fluctuate, leading to slight variations in what you receive. In contrast, a limit order gives you more control over the sale by allowing you to specify the price at which you want to sell your Bitcoin.

The order will only be executed if the market reaches your desired price, which may take more time but could secure a better rate.

Finally, be aware of the fees and processing times involved in selling Bitcoin. Coinbase charges a fee for every transaction, which varies depending on the amount sold and the method used (such as bank transfer or PayPal).

Depending on the payment method chosen, processing times can range from minutes to a few business days.

Market orders tend to have lower fees but may result in a less favorable price, while limit orders can help you avoid sudden price changes but may come with higher fees.

Method 2: Converting Bitcoin to Another Cryptocurrency

Another way to cash out Bitcoin on Coinbase is by converting Bitcoin to another cryptocurrency, such as stablecoins or altcoins.

This method is often chosen for its benefits, particularly when cashing out directly to fiat currency might not be ideal due to market conditions or personal preferences.

Converting Bitcoin to stablecoins like USDC can be advantageous because stablecoins are pegged to fiat currencies, allowing you to lock in value during volatile market periods without cashing out to a traditional bank account.

Additionally, converting to altcoins can open up opportunities to diversify your crypto portfolio and potentially gain from other assets.

To convert your Bitcoin, follow this step-by-step guide on Coinbase.

First, log into your account and select the “Trade” tab. Choose Bitcoin as the cryptocurrency you want to convert, then select your preferred cryptocurrency from the list, such as USDC or Ethereum.

Enter the amount of Bitcoin you want to convert, then click “Preview Convert” to see the conversion rate and any associated fees.

Once you’re satisfied with the details, confirm the transaction. The converted cryptocurrency will then appear in your Coinbase account, ready for future trades or withdrawals.

However, there are several risks and considerations to keep in mind when converting Bitcoin.

The value of altcoins can be highly volatile, meaning that what you convert today could rapidly change in value. Stablecoins are less volatile but still have risks, such as regulatory changes or technical issues with the coin itself.

Additionally, Coinbase may charge conversion fees, which can vary depending on the currency pair and market conditions.

Before proceeding, ensure you fully understand these risks and monitor market trends to make informed decisions when converting your Bitcoin.

Method 3: Withdrawing Bitcoin via Coinbase Card

One efficient way to cash out Bitcoin on Coinbase is by using the Coinbase Card, a Visa debit card linked directly to your Coinbase account.

The Coinbase Card allows you to instantly convert Bitcoin and other cryptocurrencies into fiat currency (such as USD or EUR) and spend it wherever Visa is accepted.

This provides the flexibility to withdraw cash from ATMs or make purchases directly, making it a convenient option for those who want instant access to their funds without needing to first transfer to a bank account.

To withdraw Bitcoin as fiat currency using the Coinbase Card, first ensure that your Coinbase Card is activated and linked to your account.

You can then head to any supported ATM and use the card just as you would with a traditional debit card.

The withdrawal will automatically convert your Bitcoin into the selected fiat currency at the current market rate.

You can also use the Coinbase app to manage your crypto balance and select which cryptocurrency you’d like to draw from when making withdrawals or purchases.

However, be mindful of the fees and limitations associated with card withdrawals.

While the Coinbase Card offers convenience, it also comes with fees, including a cryptocurrency liquidation fee and ATM withdrawal fees, which may vary depending on your region and the amount withdrawn.

Additionally, there are daily withdrawal limits, which may restrict how much you can withdraw from ATMs in a single day.

Always check these fees and limits in the Coinbase app before relying on the card for cashing out large amounts of Bitcoin.

Method 4: To cash out your balance

The platform provides a straightforward process to cash out your balance on Coinbase whether you’re using a browser or the mobile app.

Using the Browser:

- Start by signing in to your Coinbase.com account using your login credentials.

- Once logged in, navigate to the My Assets section, where you’ll find a list of your crypto and fiat balances.

- Select your local currency balance, such as USD or EUR, depending on the fiat currency you want to withdraw.

- Click on the Cash out tab and enter the specific amount you wish to cash out from your account.

- Choose the Transfer to option to select where you want to send your money, whether it’s a linked bank account, PayPal, or another payment method.

- After reviewing the details of your cash-out transaction, select Review to double-check all the information.

- Finally, select Withdraw cash to complete the transfer. Your funds will be sent to your chosen destination, typically taking a few business days to process.

Using the Mobile App:

- Access the Coinbase mobile app by logging in with your credentials.

- On the app’s dashboard, tap on My assets, then select Cash out to initiate the process.

- Enter the amount of Bitcoin (or any other cryptocurrency) you want to cash out into your local currency.

- Choose the Cash out from balance option, and then select your Deposit to destination, such as your linked bank account or PayPal.

- Review your transaction by selecting Preview cash out, where you can verify the amount and destination.

- Once everything looks correct, tap on Cash out now to finalize the process. The funds will then be transferred to your selected destination, and processing times will vary depending on your payment method.

Both methods provide a simple way to cash out, offering flexibility whether you prefer using the web or mobile app, ensuring that you can manage your funds wherever you are.

Strategies to Maximize Your Cash Out Value

To maximize the value when cashing out Bitcoin on Coinbase, it’s essential to consider timing, fees, and tax implications.

Monitoring Bitcoin Market Trends plays a critical role in maximizing your cash-out value. The price of Bitcoin fluctuates frequently, and cashing out during a market high can significantly increase your returns.

Market timing is essential because even a slight difference in Bitcoin’s price can lead to a notable change in the amount of fiat currency you receive.

Use tools and resources like CoinMarketCap, TradingView, and even Coinbase’s real-time price tracker to stay on top of price changes. Setting up price alerts can also help you catch favorable market moments for cashing out.

Minimizing Fees and Costs is another key strategy. Coinbase charges fees when you sell and withdraw Bitcoin, which can eat into your profits.

Understanding these fees is crucial, as they vary based on factors such as the method of withdrawal (bank transfer, PayPal, etc.) and the transaction size. To reduce fees, consider the timing of your transactions—fees can sometimes be lower during off-peak times.

Additionally, using Coinbase Pro, a more advanced trading platform with lower fees than the regular Coinbase app, can save money on both selling and withdrawing.

It’s also smart to compare fees across different withdrawal methods, as bank transfers typically have lower fees than PayPal, but might take longer to process.

Lastly, be aware of the tax implications of cashing out Bitcoin. In many countries, selling Bitcoin is considered a taxable event, subject to capital gains tax. If the value of your Bitcoin has increased since you purchased it, you’ll need to pay taxes on the profits.

Calculating your tax liability involves determining the difference between your purchase price (cost basis) and the selling price, and then applying the applicable capital gains tax rate, which varies depending on how long you held the asset.

To avoid headaches during tax season, keep detailed records of your Bitcoin transactions, including purchase dates, amounts, and selling prices. Many crypto tax software solutions can help you automate this process, ensuring accurate reporting.

By strategically monitoring the market, minimizing fees, and understanding tax obligations, you can maximize the value of your Bitcoin cash-out on Coinbase.

Security Considerations When Cashing Out

When cashing out Bitcoin on Coinbase, prioritizing security is essential to protect your funds and personal information.

There are several key security considerations to keep in mind.

First, it’s important to be vigilant in avoiding common scams and frauds.

One of the most prevalent threats is phishing attempts, where attackers try to steal your login details by creating fake websites or sending fraudulent emails.

Always ensure you are on the official Coinbase website or app before entering any personal information.

Check the URL for “https://” and verify that the domain is correct to avoid falling victim to fake sites.

If you’re withdrawing large sums, it’s wise to take extra precautions, such as splitting transactions into smaller amounts to minimize risk.

Additionally, you should always withdraw funds in a secure environment, avoiding public Wi-Fi or devices that may be compromised.

If you encounter any suspicious activity, such as unauthorized account access or fraudulent emails, report it immediately to Coinbase through their support system or security center.

In addition to scams, protecting your privacy is another crucial consideration. While withdrawing Bitcoin into fiat, some users may want to maintain a level of anonymity.

To do this, avoid sharing unnecessary personal details and consider using secure, privacy-focused withdrawal methods.

For example, you can use withdrawal methods that offer greater privacy, such as using PayPal or wire transfers with limited exposure of personal information.

Additionally, enabling two-factor authentication (2FA) adds an extra layer of security to your account, ensuring that even if your login credentials are compromised, an attacker would still need access to your phone or authentication app.

By recognizing fraud risks and protecting your privacy during the cash-out process, you can safely convert your Bitcoin to fiat currency on Coinbase with confidence.

THE CRYPTO MASTER CLASS

Troubleshooting Common Issues

When cashing out Bitcoin on Coinbase, users may encounter a few common issues, such as withdrawal delays or account verification problems. Knowing how to troubleshoot these can save time and reduce frustration.

Delays in Processing Withdrawals are one of the most frequent concerns.

Withdrawals may be delayed for several reasons, including high network congestion, increased security checks, or issues with the payment method you’ve chosen.

To avoid delays, ensure that your bank account or payment method is fully verified and has no restrictions.

Additionally, completing withdrawals during off-peak hours may help reduce waiting times.

If your withdrawal seems to be stuck, the first step is to check the transaction status in your Coinbase account under the My Assets or Activity section.

If it remains pending for an unusually long time, contact Coinbase support to investigate the issue further.

Another common challenge is resolving account verification problems. Many users face delays in completing the verification process due to issues such as incorrect document submissions or discrepancies in personal information.

To resolve these problems, make sure to provide clear and accurate documents when verifying your identity. Acceptable forms of ID include government-issued identification like passports or driver’s licenses.

If you continue to experience verification issues, ensure your personal information is consistent across all submitted documents.

For persistent problems, contacting Coinbase support through the app or website is the best way to get direct assistance, as they can guide you through the process and help troubleshoot any specific issues.

Understanding these common issues and knowing how to address them can ensure a smoother experience when cashing out Bitcoin on Coinbase.

Conclusion: How to Cash Out Bitcoin on Coinbase

In conclusion, cashing out Bitcoin on Coinbase can be a straightforward and secure process when approached with the right knowledge and strategies.

To begin, setting up and securing your Coinbase account is essential, ensuring that your personal details are verified, and strong security measures like two-factor authentication (2FA) are in place.

Whether you’re selling Bitcoin for fiat currency, converting it to another cryptocurrency, or using a Coinbase Card for withdrawals, understanding each method’s steps and associated fees will help you make the best decision for your needs.

Monitoring market trends, minimizing fees, and being aware of tax implications can significantly impact the profitability of your cash-out experience.

Make sure to keep an eye on Bitcoin prices for optimal timing, and explore cost-saving options like Coinbase Pro to reduce transaction fees.

Finally, protecting your privacy and avoiding common scams are crucial for ensuring that your funds remain secure.

By following these guidelines and troubleshooting any potential issues, such as withdrawal delays or account verification problems, you can maximize the value of your Bitcoin and enjoy a smooth, hassle-free cash-out experience on Coinbase.

FAQs: How to Cash Out Bitcoin on Coinbase

How long does it take to cash out Bitcoin on Coinbase?

It typically takes 1-3 business days for fiat withdrawals to reach your bank account after initiating the cash-out on Coinbase, depending on your payment method and bank processing times.

What is the minimum amount of Bitcoin I can cash out on Coinbase?

The minimum cash-out amount varies based on the payment method and your account’s verification status. Generally, there is a minimum withdrawal amount of around $2 USD worth of Bitcoin.

Are there any limits on how much I can withdraw from Coinbase?

Yes, withdrawal limits depend on your account verification level. For verified accounts, Coinbase allows larger withdrawals, but limits can vary based on factors like account history and payment methods.

Can I cash out Bitcoin on Coinbase without linking a bank account?

No, you need to link a bank account or another payment method to cash out Bitcoin. Alternatives include PayPal or wire transfers, but these also require linking your account.

How do I avoid high fees when cashing out Bitcoin on Coinbase?

To minimize fees, consider using Coinbase Pro for lower trading fees, opt for bank transfers over instant withdrawals, and ensure you choose the most cost-effective withdrawal method available.

Your blog is a true hidden gem on the internet. Your thoughtful analysis and in-depth commentary set you apart from the crowd. Keep up the excellent work!