Knowing how to buy Solana (SOL) is essential for cryptocurrency investors who want to capitalize on this new blockchain project’s promise.

Solana (SOL) has become a strong contender as the number of cryptocurrencies grows. Its innovative blockchain design promises fast transactions and the ability to grow.

Solana has gotten a lot of attention from buyers who want to make Money because it is one of the most important projects in the field of decentralized finance (DeFi).

Solana wants to solve some of the biggest problems other blockchain networks have by focusing on speed. It does this by providing a platform for creating decentralized applications (dApps) that can be used in a number of situations.

This detailed guide goes over all the details of investing in Solana. It covers everything from getting to know the project and doing lots of study on how to buy Solana tokens safely.

This guide will also give you the information and tools you need to safely and effectively buy in Solana, no matter how much experience you have with crypto or how new you are to the space.

Table of Contents

ToggleUnderstanding Solana (SOL)

What does Solana mean?

As a high-performance blockchain platform, Solana is made to serve decentralized applications (dApps) and make transactions quick and safe.

Solana stands out because of its new approach to scaling and throughput, which is meant to address the problems that other blockchain networks have.

Anastaly Yakovenko made the Solana coin (SOL) and the Solana blockchain platform. Solana was started by Anatoly Yakovenko, who has also been its architect and has been in charge of its growth since the beginning.

His ideas and knowledge of distributed systems and blockchain technology have been very important in making Solana a fast and expandable blockchain platform.

Its own coin, SOL, is used to pay for things and carry out smart contracts on the Solana network.

How does Solana do its job?

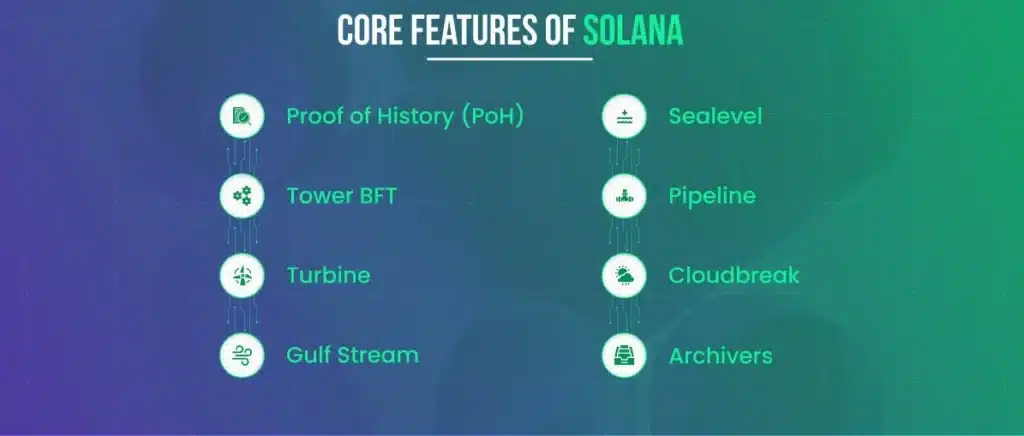

Many different technologies, such as a new consensus method called Proof of History (PoH) and a high-performance programming language called Rust, work together to give Solana its fast performance.

PoH lets Solana sort transactions before they go into the blockchain, which cuts approval times down by a large amount and boosts throughput.

Solana also uses a Byzantine Fault Tolerance (BFT) consensus method called Tower Consensus to make things safer and more reliable.

Pros of Solana

One of the best things about Solana is that it can handle thousands of events per second, which makes it very flexible for use in situations where throughput is important.

Solana is a good choice for both makers and users because it can be scaled up or down easily and has low transaction fees. It’s also easier to make and use dApps on Solana because the platform focuses on developer-friendly tools and strong infrastructure.

Solana has become the best choice for projects that want a blockchain system that can grow with them and work well.

Researching Solana (SOL) Investment

Market Analysis

It’s important to do a full market analysis before investing in Solana. This means looking at the overall trends in the cryptocurrency market, such as how the big cryptocurrencies are doing and how people feel about the market as a whole.

Figuring out how Solana fits into the bigger picture can help you figure out how to place it in the market and how it might grow and then you can get the answer yourself how to buy solana online.

Price Trends and Predictions

Investors can make smarter investment choices by looking at Solana’s price trends and making predictions based on that information.

Investors can learn more about Solana’s price changes and possible future paths by examining past price data, monitoring trading volume, and monitoring market indicators.

But it’s essential to be careful when making price predictions and get information from many different sources to get a complete picture.

Finding Reliable Sources

Finding reliable sources of information is significant in the Bitcoin space, where things change quickly.

Trusted cryptocurrency news sites, reliable analysts, and public Solana project updates can all tell you a lot about the project’s partnerships, development progress, and future milestones.

Interacting with the Solana community through forums, social media, and developer routes can also provide first-hand information and opinions about the project.

By checking information with more than one reliable source, investors can make better choices and lower their risk of relying on information that might be biased or wrong.

Choosing a Secure Exchange

Factors to Consider

There are a few things you should think about when choosing an exchange to buy Solana (SOL). This will help keep your funds safe.

First, consider how well-known and trustworthy the exchange is in cryptocurrency. Look for exchanges that have a past of keeping their customers safe and a promise to do so.

Check out the exchange’s safety features, like two-factor authentication (2FA), cold storage for funds, and encryption methods.

To ensure smooth transactions, it’s also important to look at the exchange’s liquidity, trading volume, and accepted trading pairs.

Lastly, consider how easy it is to use the exchange’s user interface. An easy-to-use tool can make trading more enjoyable overall.

Considering all these factors, you can safely buy solana on binance, Coinbase, Or Kucoin, etc.

Top Platforms for Buying Solana

You can safely buy and sell Solana (SOL) on several platforms. Binance, one of the biggest cryptocurrency exchanges in the world, has an easy-to-use website, strong security features, and many SOL trading pairs available.

Another well-known exchange, Coinbase, lets you buy SOL with real Money in a safe and secure atmosphere.

Kraken, Huobi, Kucoin, and FTX are some other well-known exchanges. Each one has its own features and services designed to meet traders’ needs and desires.

Before picking an exchange, you should look into and compare a few different ones to find the one that meets your needs and tastes the best while also being the safest and most reliable.

Setting Up Your Wallet

Types of Wallets

It’s important to have a safe place to store your Solana (SOL) or any other coin you buy.

There are different kinds of wallets, and each has its own features and safety measures. Hardware wallets, like Ledger and Trezor, keep your secret keys offline, away from hackers, so they are the safest way to store your cryptocurrency.

Software wallets, like desktop, mobile, and web wallets, make it easy to get to your Money, but they may be easier to hack if you don’t take the right security steps.

Paper wallets, in which you print out your private keys and keep them offline, are another safe way to store your cryptocurrency for a long time.

Protecting Your Wallet

No matter what kind of wallet you use, keeping your Solana (SOL) funds safe and adequately protecting them is very important.

First, make a strong password for your wallet that is unique and uses a mix of capital and lowercase letters, numbers, and special characters.

Turn on two-factor authentication (2FA) every time you can to make your account even safer.

For hardware wallets, make sure you keep your recovery seed phrase somewhere safe, ideally not online. Don’t let anyone else see your secret keys or wallet information, and be careful when using public Wi-Fi or devices you haven’t used before to access your wallet.

To reduce risks effectively, make sure you regularly update the software in your wallet and stay up to date on any possible security holes. If you follow these security best practices, you can keep your Solana goods safe from people who shouldn’t be there and from possible security breaches.

How to Buy Solana: Step-by-Step Guide

1. Making an account on the chosen exchange

First, pick a trustworthy cryptocurrency exchange that offers trading pairs for Solana (SOL). You can use Coinbase, Binance, KuCoin, OKX, or any other exchange you like.

Go to the exchange’s website or app and sign up for an account by giving your email address, making a strong password, and accepting the service terms.

2. Going through Know Your Customer (KYC) Verification

Before they can trade, many exchanges make users go through Know Your Customer (KYC) verification.

In order to do this, you usually need to show proof of your address and an ID paper like a passport or driver’s license.

To finish the KYC verification process, follow the exchange’s directions. It may take a while for the process to be approved.

3. Adding Money

You can add Money to your exchange account once it has been fully checked out. The exchange may allow you to deposit fiat cash (like USD or EUR) through a bank transfer, a credit or debit card, or cryptocurrency. Just do what the exchange tells you to do to safely add Money to your account.

4. Making an Order

Now that you have Money in your exchange account, you can make an order to buy Solana (SOL).

Find the SOL trading pair you want to trade, like SOL/USD or SOL/BTC, in the trading area of the exchange. Pick the kind of order you want to make, like a market order or a limit order, and type in how much SOL you want to buy.

Before sending the order, carefully read over the details and make sure you’re happy with the price and any fees that apply.

After you place your order, the exchange will process it, and the Solana tokens will be added to your exchange account.

These are the cheapest ways to buy Solana (SOL). If you follow these easy steps, you can buy Solana (SOL) in any cryptocurrency market without losing money.

But before making any investment choices, remember to be careful and do a lot of research.

Understanding Solana (SOL) Staking

What is Staking?

By using their cryptocurrency as collateral, users can actively participate in a blockchain network’s operations and make rewards. This is called “staking.”

For Solana (SOL), staking means giving SOL tokens to validators, who help keep the network safe and make sure transactions are legitimate.

Validators make sure that everyone agrees on what the blockchain’s state is and that it stays that way.

Participants help make the network safer and less centralized by “staking” SOL tokens. In return, they get more SOL tokens as a prize.

How to Stake Solana

Staking SOL tokens on the Solana network is a pretty easy process that can be done directly through compatible wallets or through different staking sites.

Before users can stake SOL, they need to get SOL tokens, which they can do by buying them on a cryptocurrency market or getting them in some other way.

As soon as you have SOL tokens, you can pick a staking platform or wallet that works with Solana staking and follow their specific steps to stake SOL.

A lot of staking platforms and wallets have easy-to-use screens that walk users through the process of staking and let them give their SOL tokens to validators they choose with just a few clicks.

Some sites may ask users to create a staking account or link their wallet before they can start staking SOL. After giving validators SOL tokens, participants can check their staking action and see how much they’ve earned through the staking platform or wallet dashboard.

Overall, staking SOL coins on the Solana network is a good way to make passive income while also helping to make the network safer and less centralized.

Users can get the most out of their staking rewards and help the Solana ecosystem grow by knowing how staking works and picking staking platforms or wallets that they can trust.

Strategies for Safe Trading

Signing up on the Selected Exchange

If you want to trade Solana (SOL) or any other cryptocurrency, you need to make sure you’re registered on a reliable exchange that has trading options for SOL.

To buy and sell SOL coins safely, you can use exchanges such as Coinbase, Binance, KuCoin, OKX, and more. Make sure that the exchange you pick has a good name, strong security measures, and enough trading volume for SOL.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a safe trading method that involves investing the same amount of money in SOL at regular times, even if the price of the token changes.

You can lower your risk of getting something at a high price and possibly benefit from market changes if you spread out your purchases over time.

DCA can be a good way to slowly build up SOL tokens while reducing the effects of short-term price changes because it smooths out the effects of volatility.

Setting Stop-Loss Orders

Another important safe trading approach is to set stop-loss orders to limit possible losses in case prices move against you.

With a stop-loss order, you can set a price below which your SOL holdings will be sold immediately to stop further losses. You can set clear end points and protect your investment capital from big drops in the market by using stop-loss orders.

It’s important to change your stop-loss levels based on how much risk you’re willing to take and how the market is doing to get the best safety while still letting prices rise.

If you follow these safe dealing tips, you can confidently move through the unstable cryptocurrency markets and lower the risk of buying and selling Solana (SOL) tokens.

Remember to keep up with the news, be disciplined in how you trade, and always put the safety of your finances first.

Keeping Up with Solana (SOL) News and Updates

News Sources You Can Trust

Keeping up with the latest news and information about Solana (SOL) is important for making smart financial choices. Look for trustworthy news sites that cover blockchain and cryptocurrency, like CoinDesk, CoinTelegraph, and DigitalCurrencyAge.

These platforms give you the most up-to-date information on Solana’s partnerships, growth progress, and important news. You could also sign up for newsletters or join online communities that are all about Solana to get timely changes sent right to your inbox.

Follow these social media Sites

They are very important for spreading news and information about Solana (SOL) and getting people involved in the community.

Follow public Solana accounts on Twitter, Telegram, and Reddit to find out what’s going on and talk to other people who are interested in Solana.

Additionally, you might want to follow well-known people in the cryptocurrency world who talk about Solana a lot and offer useful information.

By constantly monitoring social media channels, you can stay ahead of the curve and learn useful things about Solana’s ecosystem. This will help you make better investment decisions.

Risks Associated with Solana (SOL) Investment

Buyers should be aware of the risks associated with investing in Solana (SOL) or any other cryptocurrency.

Market Volatility

Market fluctuation is one of the main risks of investing in Solana. As you may know, cryptocurrency markets are known for having big and random price changes.

Price volatility can give buyers big gains, but it can also cause them to lose a lot of money.

Before putting money into Solana or any other cryptocurrency, investors need to think carefully about how much risk they are willing to take and what their financial goals are.

Regulatory Risks

Another big risk for Solana investments is the lack of confidence in regulations. Around the world, governments and regulatory groups are still working on making rules about cryptocurrencies and putting them into effect.

If the rules change, like making it harder to trade or raising taxes, it could affect the value and legality of Solana and another cryptocurrency.

Investors should keep up with changes in their own countries’ rules and consider how those changes might affect their investment accounts.

Common Scams in the Crypto Space

There are a lot of scams and frauds in the cryptocurrency space that try to take advantage of people who don’t know what’s going on. Phishing attacks, Ponzi schemes, and fake initial coin offers (ICOs) are all common types of scams.

Before putting money into any coin project, investors should be careful and do their research. Watch out for deals that seem too good to be true, and always make sure that projects and people are real before giving them money.

Watch Out for Red Flags

If you’re thinking about investing in Solana or any other cryptocurrency, it’s important to be aware of any red flags that could mean fraud or possible risks.

Watch out for red flags like claims of huge returns that are too good to be true, unclear information about the project’s goals and progress, and sketchy behavior from the project’s founders or team members.

Investors should also be wary of projects with poorly written white papers, material, or code.

By being aware of the risks of investing in Solana and being careful, investors can lower their chances of losing money and make better decisions about their investments in the volatile cryptocurrency market.

To protect your investments in Solana and other cryptocurrencies, you need to do extensive research, keep up with legal changes, and watch out for scams and other warning signs.

Conclusion

I’ve discussed all the different ways on how to buy Solana (SOL) safely and securely and how to navigate the constantly changing world of cryptocurrency investing.

To help you feel confident about starting your Solana investment journey, we’ve covered important steps like learning the basics of digital currency and doing extensive research, as well as picking safe exchanges, creating wallets, and using trade strategies for safety.

I’ve talked about how important it is to stay up to date on Solana news and updates, stay away from scams and risks, and know the possible risks that come with investing in Solana, such as market volatility, government uncertainty, and common crypto scams.

I’ve also talked about the idea of “Solana staking” and the advantages of adding SOL tokens to your stock to make it more diverse.

As with any business, it’s important to be careful when investing in Solana, do a lot of research, and keep up with changes in the market and regulations.

By following the tips in this guide and staying alert, you can lower your risks, protect your finances, and maybe even make money in the exciting world of Solana and cryptocurrency.

Solana is a tool that could be useful for decentralized apps and new ideas in the blockchain space.

With the right knowledge, tools, and attitude, you can navigate the complicated world of Solana investment and set yourself up for success in the changing world of cryptocurrencies.

I hope you have enough ideas on how to buy Solana safely and securely in the USA or anywhere else by following the guidelines. Please comment below with your thoughts about this post and share it with others.

Also, please subscribe to our email newsletter to keep receiving the news and updates on cryptocurrency.

Frequently Asked Questions

What is Solana?

Solana is a high-performance blockchain platform designed for decentralized applications and cryptocurrency transactions. It aims to provide scalability and fast transaction speeds through innovative technology.

Is Solana a Good Investment?

Investing in Solana can be a good option for those interested in the potential of its technology and the growth of its ecosystem. However, like all investments, it carries risks and requires thorough research.

How Can I Buy Solana Safely?

You can buy Solana safely by using reputable cryptocurrency exchanges, ensuring they have proper security measures and regulatory compliance. Additionally, research and verify the exchange's reputation before making transactions.

How Do I Store Solana Securely?

You can store Solana securely by using hardware wallets, such as Ledger or Trezor, or reputable software wallets that offer strong encryption and security features. Ensure to keep your private keys safe and never share them with anyone.

What Are the Tax Implications of Investing in Solana?

Tax implications of investing in Solana vary depending on your jurisdiction. Consult with a tax professional to understand the specific tax regulations and reporting requirements applicable to your investment activities.

How Can I Avoid Scams When Buying Solana?

To avoid scams when buying Solana, research thoroughly, use reputable exchanges, and be cautious of offers that seem too good to be true. Avoid sharing sensitive information and verify the legitimacy of projects and individuals before investing.

Can I Stake Solana?

Yes, you can stake Solana to participate in the network's operations and earn rewards. Staking involves locking up SOL tokens as collateral to support the network's security and decentralization.

What Risks Should I Be Aware of When Investing in Solana?

Risks associated with investing in Solana include market volatility, regulatory uncertainties, potential security breaches, and the risk of scams or fraudulent activities. It's essential to conduct thorough research and understand these risks before investing.

Where to buy Solana?

You can buy Solana on various cryptocurrency exchanges such as Binance, Coinbase, Kraken, and others that support trading pairs with SOL tokens.

Why is Solana pumping?

Solana's price may experience increases, or "pumps," due to factors such as growing adoption, positive news and announcements, increased investor interest, and overall market trends.

How high can Solana go?

Predicting the future price of Solana is challenging and speculative. While some analysts may offer price predictions, it's essential to approach them with caution and consider various factors influencing Solana's price trajectory.

Can Solana reach $1000?

Whether Solana can reach $1000 is uncertain and depends on various factors, including market conditions, adoption rates, technological advancements, and regulatory developments.

What is the fastest way to buy Solana?

The fastest way to buy Solana is through instant-buy features offered by some cryptocurrency exchanges, which allow you to purchase SOL tokens quickly using fiat currency or other cryptocurrencies. However, ensure to prioritize safety and security when using such features.