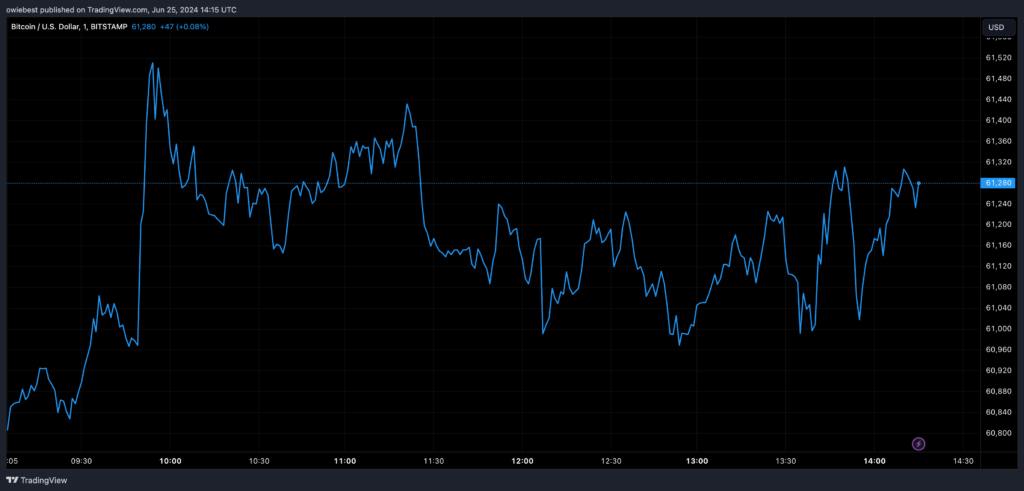

“Bitcoin dropped to $60,000 in the last 24 hours before rising again, but crypto research firm 10x Research thinks BTC could fall even more in the near future.” The company gave a number of reasons for its gloomy prediction.

Table of Contents

ToggleBTC might fall as low as $50,000.

Markus Thielen, the lead analyst at 10x Research, said in a recent study that Bitcoin prices could drop to around $50,000.

He pointed out a possible trend of a peak in Bitcoin’s chart that could cause such a big drop.

Thielen also noticed that Bitcoin’s price had been stuck in a range for a long time and that it had made several false breakouts, which is typical of this type of trend.

However, because Bitcoin is in a topping formation, the study warned that this pattern has previously left small investors open to losses, which has led to big drops in many altcoins along with Bitcoin.

Thielen stressed how important the $61,500 price level was for Bitcoin, saying that an extended trade below this level could confirm the possible drop to $50,000.

10x Research highlighted several factors contributing to their pessimistic outlook.

One factor is the absence of new capital entering the crypto market, evidenced by net outflows from US Spot Bitcoin ETFs, which have seen $1.2 billion leave since June 10.

Additionally, significant trader liquidations amounted to $0.8 billion in Bitcoin and $0.9 billion in Ethereum positions wiped out this past week.

Low network activity on Ethereum further supports 10x Research’s bearish stance on Bitcoin. Transaction fees on Ethereum have dropped to their lowest levels since 2020, indicating reduced investor interest despite upgrades like the EIP-1559 aimed at lowering gas fees.

Concerns also arise from Bitcoin miners nearing break-even costs, potentially increasing sell pressure on BTC. Reports suggest miners have already offloaded over 30,000 BTC ($2 billion) this month, contributing to Bitcoin’s recent decline.

But, based on history, Bitcoin probably won't fall as low as $50,000.

Based on past trends, crypto expert Rekt Capital recently said that Bitcoin is likely to keep its support above $60,000.

He said that BTC has always held its re-accumulation range low as support during the times after the halves.

He named the current $60,000 level as the most important re-accumulation range low.

Rekt Capital also said that an extended bull market seems possible, pointing out that Bitcoin’s acceleration rate has dropped from 260 days to 160. He also noticed that Bitcoin’s acceleration has been steadily slowed down during this cycle by staying in the reaccumulation band.